Whether you’re seeking a comprehensive private wealth approach or a specialized strategy to enhance your existing portfolio, we deliver tailored options designed for you. Our investor-first mindset, backed by industry-leading independent research, meets the demands of a new era.

Explore two

distinct paths

At Ewing Morris, our wealth management philosophy begins with understanding you— your goals, your risk tolerance, and your vision for the future. That is why we take the time to get to know every person and family, not just from a wealth management perspective, but from a human perspective.

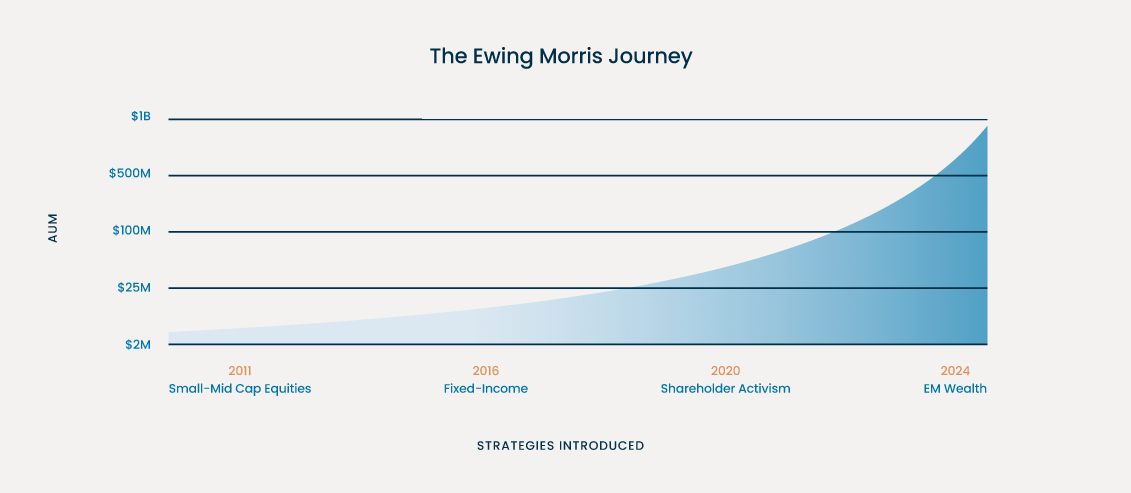

At Ewing Morris, we describe our approach as applying a private equity mindset. Investing in targeted solutions through our specialized funds, including small/mid-cap equities, high-yield bonds, our Partners Fund, and Special Purpose Vehicles.

At Ewing Morris, our wealth management philosophy begins with understanding you—your goals, your risk tolerance, and your vision for the future. It’s why we take the time to get to know every person and family not just from a wealth management perspective, but from a human perspective.

John Ewing and Darcy Morris, 2011

Are you an accredited investor interested in alternative ways to build wealth?

Creating a custom-fit solution to enhance your portfolio begins by learning about your investment potential.

Schedule a meeting to review your portfolio.

Connect with us today!

"*" indicates required fields

We are committed to operational excellence by alligning with recognized industry leaders